Life insurance can be a confusing topic for many. It is essential as it provides financial security for loved ones in case of unforeseen events. Understanding how life insurance works can help individuals make informed decisions about their future and their family’s protection.

There are different types of life insurance, and knowing the differences can guide people in choosing the right policy. The process of applying for and maintaining a life insurance policy also requires attention. With the right information, anyone can navigate this important aspect of financial planning.

Key Takeaways

- Life insurance provides crucial support for families in tough times.

- Different types of policies are available to meet various needs.

- Prope

- r management of the policy ensures it remains effective over time.

Fundamentals of Life Insurance

Life insurance is a way to provide financial support to loved ones after a person’s death. It offers peace of mind and helps ensure that dependents are taken care of financially. Understanding the key types of life insurance, the differences between policies, and how to determine the right coverage is essential.

Types of Life Insurance Policies

There are several types of life insurance policies to consider. The most common ones are term life and whole life insurance.

-

Term Life Insurance: This policy lasts for a specific period, such as 10, 20, or 30 years. If the insured dies during this time, the policy pays a death benefit to the beneficiaries. If they outlive the term, there is no payout.

-

Whole Life Insurance: This policy provides coverage for the insured’s entire life. It also includes a savings component, which grows over time. The premium is generally higher, but it guarantees a payout no matter when the insured passes away.

Each type has its own advantages and fits different needs.

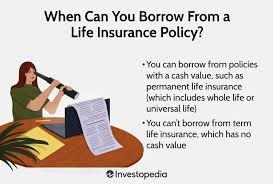

Term vs. Permanent Life Insurance

Term and permanent life insurance have distinct features that cater to different goals.

-

Term Life Insurance: It is often less expensive than permanent plans. People usually choose it for temporary needs, like paying off a mortgage or raising children.

-

Permanent Life Insurance: This includes whole life and universal life. These policies build cash value over time. They are more suitable for long-term financial planning and can provide lifetime coverage.

Choosing between these types requires careful thought about personal financial goals and needs.

Determining Your Coverage Needs

Determining how much life insurance coverage is necessary can be challenging. Several factors influence this amount, including:

-

Income: Consider how much income will need to be replaced for dependents. A common rule is 10-15 times the annual income.

-

Debts: Calculate any outstanding debts, such as loans or credit cards. These amounts should be covered to avoid financial burden on survivors.

-

Future Expenses: Account for future costs like children’s education and retirement savings for a spouse.

Overall, assessing one’s financial situation allows for better planning and ensures that the chosen policy meets future needs.

Policy Application and Maintenance

Applying for life insurance and maintaining the policy involves understanding costs, the application process, and ongoing management. Each aspect is important for ensuring that the policy meets the holder’s needs over time.

Understanding Policy Costs and Fees

Life insurance policies have different costs that can vary based on the type of coverage. Common costs include premiums, which are regular payments made to keep the policy active. In addition to premiums, there may be fees for policy changes or riders, which provide extra benefits.

Here are some typical costs associated with life insurance:

| Cost Type | Description |

|---|---|

| Premiums | Regular payments for coverage |

| Policy Fees | Charges for administrative costs |

| Riders | Additional benefits (e.g., disability) |

Knowing these costs helps policyholders budget and avoid surprises.

The Application Process

The application process for life insurance typically starts with filling out a form. This form requires personal information, such as age, health history, and lifestyle choices. The insurer uses this information to assess risk and determine coverage options.

Some key steps in the application process are:

- Completing the Application: Providing accurate and complete information.

- Medical Exam: Undergoing a health check if required.

- Review Process: Insurer evaluates the application before approving coverage.

Policyholders should be honest in their answers to avoid issues in the future.

Managing and Updating Your Policy

Once a policy is in place, it’s essential to manage it well. This includes regularly reviewing coverage to ensure it meets current needs. Changes in life circumstances, like marriage or having children, can impact what kind of coverage is necessary.

Policyholders should also keep the following in mind:

- Contact Information: Update personal information, like addresses and beneficiaries.

- Policy Review: Assess coverage every few years or after major life events.

- Payment Management: Ensure premiums are paid on time to prevent policy lapse.

Proactive management helps maintain effective life insurance coverage.

Also Read :