Cheap Car Insurance: Essential Tips for Finding the Best Deals

Finding affordable car insurance can feel overwhelming, especially with the myriad of options available. Many consumers can save significantly by comparing rates from multiple insurers, as costs vary widely based on factors such as location, driving history, and vehicle type. By researching and understanding the various offers, individuals can pinpoint the best policy that fits their budget and needs.

Budget-conscious drivers should look for key features in their insurance plans. Identifying discounts, such as those for safe driving or bundling policies, can lead to significant savings. Additionally, using tools like insurance comparison websites allows consumers to quickly evaluate their options side by side, ensuring they make an informed decision.

Considering the importance of adequate coverage, it is crucial to strike a balance between affordability and protection. Policymakers and financial experts alike recommend regularly reviewing insurance policies to stay updated on the best rates and coverage options available.

Understanding Car Insurance

Car insurance is essential for drivers, providing financial protection in the event of accidents or damage. It is crucial to understand the various types of coverage available, factors influencing premiums, and specific state requirements that dictate minimum coverage levels.

Types of Coverage

There are several types of coverage included in car insurance policies. The most common are:

- Liability Insurance: Covers damages and injuries caused to others if the policyholder is at fault in an accident.

- Collision Coverage: Pays for damage to the policyholder’s vehicle resulting from a collision, regardless of fault.

- Comprehensive Coverage: Protects against non-collision-related incidents, such as theft, vandalism, or natural disasters.

- Personal Injury Protection (PIP): Covers medical expenses for the driver and passengers, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: Offers protection if involved in an accident with a driver lacking sufficient insurance.

Each coverage type serves a distinct purpose, and drivers should assess their needs to choose a suitable policy.

Determining Factors for Premiums

Several factors influence the cost of car insurance premiums. These include:

- Driving History: A clean driving record typically results in lower premiums, while accidents or violations can increase costs.

- Vehicle Type: Insurance costs vary based on the vehicle’s make, model, and safety ratings. High-performance cars often have higher premiums.

- Location: The area where the driver resides can impact rates. Urban areas may have higher premiums due to increased accident risk.

- Credit Score: Many insurers consider credit history when determining premiums. A higher score can lead to lower rates.

- Age and Gender: Younger drivers and males may face higher premiums due to statistical risk factors.

Understanding these factors can help drivers make informed decisions about their insurance.

State Requirements and Minimums

Each state mandates specific insurance requirements for drivers. Generally, these include:

- Minimum Liability Coverage: Most states require drivers to have a certain level of liability insurance to cover bodily injury and property damage.

- No-Fault Laws: Some states have no-fault insurance systems, which necessitate Personal Injury Protection to cover medical expenses irrespective of fault.

- Proof of Insurance: Drivers must provide proof of insurance when requested by law enforcement or during vehicle registration.

Familiarity with state requirements is vital for legal compliance and avoiding penalties.

Finding Cheap Car Insurance

Finding affordable car insurance requires strategic planning and informed decision-making. Through a careful comparison of quotes, taking advantage of discounts, and assessing insurer reliability, individuals can secure the best coverage at the lowest possible cost.

Comparing Insurance Quotes

When seeking cheap car insurance, comparing quotes is essential. Utilizing online comparison tools such as The Zebra can simplify this process. These tools allow consumers to evaluate rates from multiple insurers, including major names like GEICO, Progressive, and Allstate.

To compare effectively, individuals should consider specific factors like:

- Coverage options: Ensure adequate protection.

- Premium rates: Look for competitive pricing.

- Deductibles: Weigh the costs against potential benefits.

By reviewing several quotes side by side, it is possible to find the most suitable policy without compromising coverage quality.

Discounts and Savings Strategies

Insurers often provide various discounts that can significantly reduce premiums. Drivers should inquire about the following options:

- Multi-policy discounts: Bundling auto insurance with home or life insurance can yield savings.

- Safe driver discounts: Maintaining a clean driving record may qualify individuals for lower rates.

- Student and group discounts: Certain affiliations, like being a student or part of specific organizations, can lead to reduced premiums.

It’s crucial for policyholders to communicate with their insurance agents to ensure they are maximizing available savings opportunities. Many insurers offer personalized discounts that can significantly decrease costs.

Evaluating Insurer Reliability and Service

While price is a primary concern, evaluating an insurer’s reliability and customer service is equally important. Online reviews and ratings from organizations like J.D. Power can provide insights into customer satisfaction levels.

Key metrics to consider include:

- Claims handling: Investigate how quickly and efficiently claims are processed.

- Financial stability: Research the insurer’s financial ratings to ensure they can meet obligations.

- Customer support availability: Determine if the insurer offers accessible support options, such as online chat or 24/7 support.

A reliable insurance provider can enhance the experience and ensure peace of mind during the policy period.

Frequently Asked Questions

Finding cheap car insurance involves understanding options, coverage levels, and how to manage costs effectively. The following questions address common concerns related to affordable car insurance.

How can I find affordable car insurance in my area?

To locate affordable car insurance, individuals should start by comparing quotes from multiple providers. Online comparison tools can simplify this process, allowing users to evaluate coverage options and premiums from various insurance companies.

What are the options for low deposit car insurance plans?

Low deposit car insurance plans often require minimal upfront payments. Many insurers offer these plans as part of their affordable coverage options, making it easier for people on a tight budget to secure insurance without a large initial payment.

What methods can I use to lower my monthly car insurance payments?

Several methods exist to reduce monthly car insurance payments. Increasing deductibles, bundling policies, and maintaining a good driving record are effective strategies. Additionally, exploring discounts for safe driving or membership affiliations can lead to savings.

Can I get full coverage car insurance without breaking the bank?

Yes, individuals can obtain full coverage car insurance at a reasonable cost. Shopping around for the best rates and selecting appropriate coverage limits can help manage expenses while providing comprehensive protection.

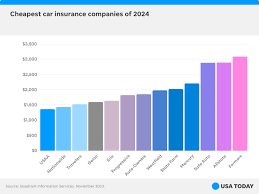

Which companies are known for offering the least expensive car insurance rates?

Some companies are recognized for their affordable car insurance rates. Providers such as GEICO, Progressive, and Nationwide frequently appear in comparisons for low-cost coverage options due to their competitive pricing.

What are the minimum car insurance requirements to be legally insured?

Minimum car insurance requirements vary by state. Most states mandate liability coverage to cover damages to other drivers and their property, while some may require additional coverage types, such as uninsured motorist insurance. Checking local regulations is crucial for compliance.

Also Read :