Visits: 1

Looking for a PayPal alternative? Whether you’re dissatisfied with PayPal’s fees or simply want to explore other options, this article has got you covered. We’ve compiled a list of the top 10 popular alternatives to PayPal, including Stripe, Skrill, TransferWise, Payoneer, Amazon Pay, Google Wallet, 2Checkout, and Dwolla. Each option is thoroughly reviewed, highlighting their unique features and benefits. By the end of this article, you’ll be equipped with the knowledge to choose the right PayPal alternative for your business needs.

Why Consider Alternatives to PayPal

As a business owner, you may have come to rely on PayPal as your go-to payment solution. However, it’s important to consider that there are other options available that may better suit the needs of your business. For example, some alternatives offer lower fees or more comprehensive features. Additionally, if you’ve had any negative experiences with PayPal in the past, it may be worth exploring other options.

In this article, we’ll explore ten popular alternatives to PayPal and help you choose the right payment solution for your business.

1. Stripe: A Comprehensive Payment Solution

Stripe is a popular payment solution that offers comprehensive features for businesses of all sizes. It allows you to accept payments from customers in over 135 currencies, making it an ideal choice for international transactions. Stripe also offers a range of payment options, including credit cards, debit cards, and digital wallets like Apple Pay and Google Pay.

One of the standout features of Stripe is its easy integration with e-commerce platforms like Shopify and WooCommerce. This means that you can quickly set up your online store and start accepting payments without any technical expertise. Additionally, Stripe offers robust security features, including two-factor authentication and fraud prevention tools, to ensure that your transactions are safe and secure.

Another benefit of using Stripe is its transparent pricing model. Unlike PayPal, which charges a percentage of each transaction plus a fixed fee, Stripe charges a flat rate of 2.9% + 30 cents per successful transaction. This makes it easier to calculate your costs and manage your cash flow.

Overall, Stripe is a comprehensive payment solution that offers a range of features and benefits for businesses. Whether you’re just starting out or looking to expand internationally, Stripe can help you streamline your payment process and grow your business.

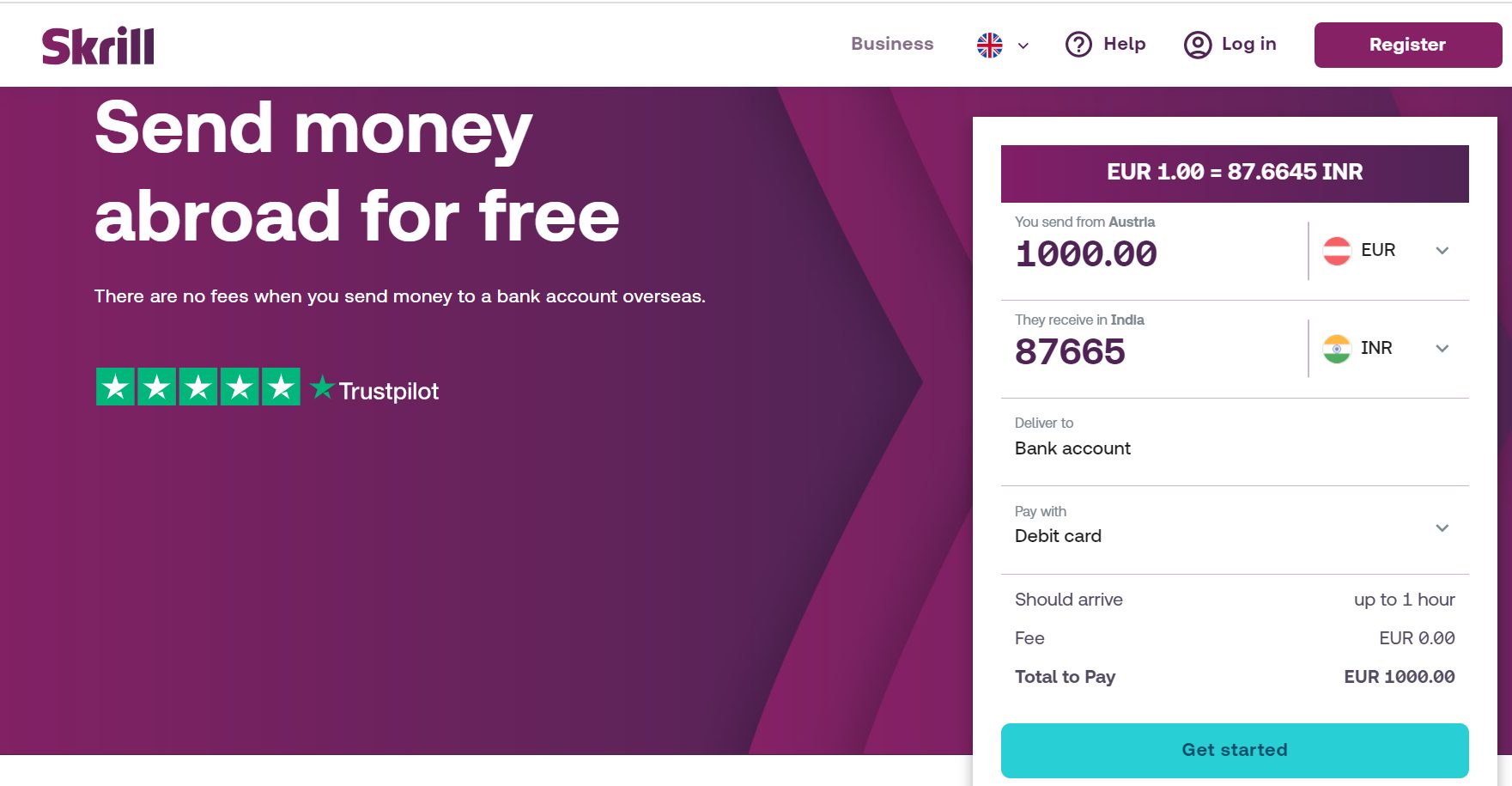

2. Skrill: A Global Payment Gateway

Top 10 Popular Alternatives to PayPal: Choosing the Right Payment Solution for Your Business

Skrill is a popular payment gateway that offers its services globally. It allows businesses to accept payments in over 40 currencies and from over 200 countries. Skrill’s platform is user-friendly, making it easy for businesses to set up an account and start accepting payments quickly.

One of the benefits of using Skrill is its low transaction fees, which can be as low as 1% for certain transactions. Additionally, Skrill offers fraud protection and chargeback prevention measures to help protect businesses from fraudulent activities.

Skrill also offers a range of features, including recurring payments, invoicing, and subscription billing, making it a great option for businesses with recurring revenue models. Furthermore, Skrill’s mobile app allows businesses to manage their accounts on-the-go, providing convenience and flexibility.

Overall, Skrill is a reliable and secure payment gateway that offers businesses a global reach and a variety of features at competitive prices.

3. TransferWise: Low-Cost International Transfers

For businesses that operate globally, international transfers can be a hassle. PayPal’s fees for international transactions can add up quickly, making it an expensive option. That’s where TransferWise comes in. This payment solution offers low-cost international transfers with transparent fees and exchange rates. TransferWise also allows you to hold and manage multiple currencies in one account, making it easier to do business with customers and suppliers around the world. With over 8 million users and $5 billion transferred every month, TransferWise is a trusted and reliable alternative to PayPal for international payments.

4. Payoneer: A Popular Choice for Freelancers

Payoneer is a payment solution that has gained popularity among freelancers worldwide. It offers a range of services such as global payments, cross-border transactions, and multi-currency support. Freelancers can receive payments from clients in different countries, withdraw funds to their local bank accounts, and even get paid directly onto a prepaid Mastercard. Payoneer also provides a user-friendly platform that allows freelancers to track their payments and manage their finances efficiently. With over 4 million users worldwide, Payoneer is a trusted payment solution for freelancers looking for a reliable alternative to PayPal.

5. Amazon Pay: Seamless Integration with Amazon

Amazon Pay is a payment solution that allows customers to use their Amazon account to make purchases on your website. This means that customers can easily check out using the information already stored in their Amazon account, without having to enter their shipping and billing details again.

One of the biggest advantages of Amazon Pay is its seamless integration with Amazon. If you’re already selling products on Amazon, adding Amazon Pay to your website can help you streamline your payment process and provide a more convenient shopping experience for your customers.

In addition, Amazon Pay offers fraud protection and a familiar checkout experience for customers, which can help increase trust and reduce cart abandonment rates. However, it’s important to note that Amazon Pay does come with fees, so be sure to compare them with other payment solutions before making a decision.

6. Google Wallet: Easy Payments with Google Accounts

Google Wallet is a payment solution that allows users to make easy payments with their Google accounts. It is a fast and secure way to send and receive money online. With Google Wallet, you can easily transfer funds to friends and family or pay for goods and services online. The service is free to use, and it is available on both Android and iOS devices. Google Wallet also offers fraud protection and 24/7 customer support to ensure that your transactions are safe and secure. Additionally, Google Wallet can be used to store loyalty cards and gift cards, making it a convenient all-in-one payment solution.

7. 2Checkout: Multiple Payment Options for E-commerce

2Checkout is a payment solution that offers multiple payment options for e-commerce businesses. It supports over 45 payment methods, including credit cards, PayPal, and Apple Pay. With 2Checkout, you can accept payments in more than 200 countries and territories, making it a great option for businesses with a global customer base.

One of the key features of 2Checkout is its customizable checkout process. You can design your own checkout page to match your brand’s look and feel, and choose which payment methods to display. This can help improve the user experience and increase conversion rates.

2Checkout also offers fraud protection and chargeback management services, helping to keep your business safe from fraudulent transactions. Additionally, it provides detailed reporting and analytics, giving you insights into your sales performance and customer behavior.

Overall, 2Checkout is a versatile payment solution that can be tailored to meet the needs of your e-commerce business. Its wide range of payment options, customizable checkout process, and fraud protection services make it a popular choice among online merchants.

8. Dwolla: ACH Payments Made Simple

Dwolla is a payment solution that simplifies ACH payments for businesses. It offers a secure platform for businesses to send and receive payments directly from their bank accounts. With Dwolla, businesses can automate recurring payments, split payments, and even facilitate mass payouts.

One of the benefits of using Dwolla is its low transaction fees. Unlike other payment solutions, Dwolla charges a flat fee per transaction, regardless of the transaction amount. This makes it an ideal choice for businesses that process high-value transactions.

Another advantage of Dwolla is its easy integration with existing systems. Businesses can easily integrate Dwolla into their website or mobile app using its API. This allows them to offer their customers a seamless payment experience without redirecting them to a third-party payment gateway.

Overall, Dwolla is a great alternative to PayPal for businesses that require a simple and cost-effective way to process ACH payments. Its user-friendly interface, low transaction fees, and easy integration make it a popular choice among businesses of all sizes.

9. QuickBooks Go Payment

• Requires a credit card reader for retailers to take payments right from a mobile phone or tablet.

• Swipe rates starting as low as 1.6% for pay-as-you-go or monthly plans are available starting at $19.95.

• It works with iPhones, iPads, Android phones, and Android tablets.

10. Shopify Payments

• Requires a Shopify account to accept Shopify Payments.

• Customers can use their preferred payment methods such as Visa, Mastercard, or ApplePay.

• Includes a built-in fraud analysis feature and flags orders that are potentially fraudulent.

• Pricing plans for Shopify account sellers range from $29/month to $299/month.

Choosing the Right PayPal Alternative for Your Business

After exploring the top 10 popular alternatives to PayPal, it’s clear that there are plenty of options available for businesses looking for a payment solution. Each alternative has its own unique features and benefits, so it’s important to carefully consider which one is right for your business.

When making your decision, think about what matters most to you and your customers. Do you need a comprehensive payment solution like Stripe or a global payment gateway like Skrill? Are low-cost international transfers a priority for you, making TransferWise the best choice? Or do you need a popular choice for freelancers like Payoneer?

Does PayPal Provide Protection for Buyers?

PayPal helps keep transactions secure by not sharing financial information with sellers and also monitors transactions 24/7. PayPal also monitors fraud prevention and helps with dispute resolution, putting a hold on funds until the issue is resolved

What Online Payment Platform Do Merchants Prefer?

According to Forbes, the favorite payment platform for merchants in 2022 was Square

What Is a Cryptocurrency Payment Gateway?

A cryptocurrency payment gateway is a payment processor for digital currencies, similar to the payment processors, or gateways, that banks or credit cards use. Cryptocurrency gateways enable you to accept digital payments and receive fiat currency immediately in exchange.

Conclusion

Consider factors such as ease of use, fees, security, customer support, and integration with your existing systems. By taking the time to research and compare these alternatives, you can find the right payment solution to meet your business needs and help you grow and succeed.

%20(1).png)