Visits: 1

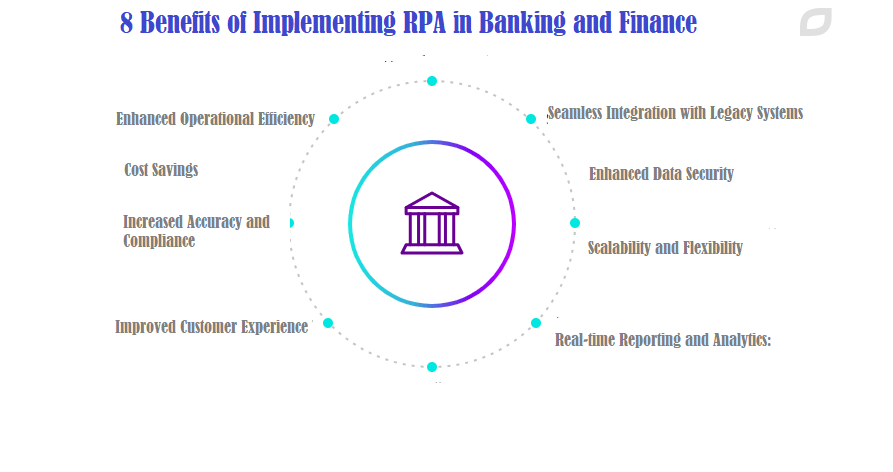

8 Benefits of Implementing RPA in Banking and Finance

Robotic Process Automation (RPA) has emerged as a game-changer in the banking and finance industry, revolutionizing how routine and repetitive tasks are performed. RPA involves the use of software robots or “bots” to automate manual processes, resulting in increased efficiency, accuracy, and cost savings. In this post, we will explore the numerous advantages of implementing RPA in the banking and finance sector.

1. Enhanced Operational Efficiency:

By automating repetitive tasks such as data entry, account reconciliation, and report generation, RPA significantly improves operational efficiency. Bots can work tirelessly 24/7, leading to faster and error-free execution of processes, ultimately reducing the turnaround time for various operations.

2. Cost Savings:

RPA implementation allows banks and financial institutions to cut costs significantly. By eliminating the need for human intervention in repetitive tasks, organizations can optimize workforce allocation, reduce labor expenses, and achieve a higher return on investment (ROI).

3. Increased Accuracy and Compliance:

Manual data entry is prone to errors, which can have severe consequences in the banking and finance sector. RPA ensures high accuracy levels, reducing the risk of costly mistakes and enhancing compliance with industry regulations and standards.

4. Improved Customer Experience:

RPA streamlines back-end processes, leading to faster processing of customer requests, account openings, and loan approvals. This, in turn, enhances the overall customer experience by reducing waiting times and providing timely and error-free services.

5. Seamless Integration with Legacy Systems:

RPA can be seamlessly integrated with existing legacy systems, eliminating the need for extensive infrastructure overhauls. This makes the adoption of RPA cost-effective and less disruptive to ongoing operations.

6. Enhanced Data Security:

Data security is of utmost importance in the banking and finance sector. RPA tools are designed to adhere to strict security protocols, ensuring that sensitive information is handled and stored securely, reducing the risk of data breaches.

7. Scalability and Flexibility:

As the banking and finance industry evolves, RPA can easily adapt to changing requirements and accommodate increased workloads. Organizations can scale RPA deployments as needed, making it a versatile solution to meet business demands.

8. Real-time Reporting and Analytics:

RPA generates real-time insights through data collection and analysis. By providing accurate and up-to-date information, decision-makers can make informed choices promptly, enabling the organization to stay competitive in a dynamic market.

Conclusion

The implementation of RPA in the banking and finance industry offers a myriad of benefits, revolutionizing traditional processes and driving digital transformation. From cost savings to enhanced customer experience and improved compliance, RPA proves to be a powerful tool in optimizing operational efficiency and staying ahead in a highly competitive landscape.

As banks and financial institutions continue to embrace technological advancements, RPA is becoming an indispensable asset in achieving business objectives, streamlining operations, and delivering exceptional services to customers.

Frequently asked questions (FAQs) related to implementing RPA in the banking and finance industry:

1. What are the typical processes in banking and finance that can be automated using RPA?

RPA can be applied to various processes in banking and finance, including customer onboarding, account reconciliation, fraud detection, loan processing, and invoice processing, among others.

2. How long does it take to implement RPA in a banking or financial institution?

The implementation timeline for RPA varies depending on the complexity and scope of the automation. Simple processes can be automated quickly, while complex ones may take weeks.

3. What skills are required to deploy and manage RPA bots in the banking sector?

RPA implementation and management require skills in process analysis, programming, and automation. Robotic Process Automation specialists and developers play a vital role in deploying and maintaining RPA bots.

4. Can RPA bots interact with multiple software systems and applications used in banking and finance?

RPA bots are versatile, interacting with multiple software systems and applications.

5. Is RPA compatible with cloud-based banking systems and applications?

RPA seamlessly integrates with cloud-based banking systems for seamless automation.

6. How does RPA impact the workforce in the banking and finance industry?

RPA enables human workers to focus on strategic, complex tasks, requiring creativity and critical thinking.

7. What are the potential risks associated with RPA implementation in banking and finance?

RPA benefits, risks include data security, integration challenges, employee resistance.

8. What is RPA potential for enhanced AML compliance.

Yes, RPA can enhance AML compliance by automating transaction monitoring, customer due diligence, and suspicious activity reporting, ensuring that banks adhere to regulatory requirements.

9. Does RPA require significant changes to existing IT infrastructure in banking institutions?

RPA optimizes IT infrastructure without extensive changes. Ensure compatibility and secure connections for successful automation.

10. What is the potential ROI of RPA implementation in banking and finance?

The ROI of RPA varies depending on the scale and scope of automation. Banks and financial institutions can experience significant cost savings, improved efficiency, and enhanced customer satisfaction, contributing to a positive ROI.

11. How does RPA contribute to error reduction in financial processes?

RPA bots automate data entry, reduce human errors, and follow predefined rules.

12. Can RPA support the banking industry in adapting to changing regulations and compliance requirements?

Yes, RPA’s agility allows it to quickly adapt to changing regulations, making compliance updates and adjustments more efficient and ensuring that banks remain compliant with evolving standards.

RPA revolutionizes banking and finance processes, enabling digital transformation and benefits. As organizations embrace automation, they can leverage RPA to drive innovation, efficiency, and competitive advantage.

%20(1).png)